Banking Support

Fixed Deposits

One of the most reliable asset management options is “utilizing Malaysian bank deposits”.

About Malaysian Fixed Deposits

Currently, Malaysian bank interest rates for 1-year fixed deposits are around 2.10-2.50%. (Please note that bank interest rates fluctuate and vary by bank.) Fortunately, interest income is currently tax-free, so 100% of interest income goes to the depositor. Malaysia also has a deposit protection scheme guaranteeing up to RM250,000 per bank (approximately 750,000 yen at 1RM=30 yen).

The Central Bank of Malaysia maintains strict supervision, and no Malaysian bank has ever gone bankrupt or experienced a bank run, making Malaysian bank deposits safe. However, to open a bank account in Malaysia, you typically need a local visa such as MM2H or a work visa.

Banking Support Services

1. New Account Opening

When opening a new account, procedures differ by bank. We provide support to ensure smooth account opening.

(Note) Those without a valid local visa or who have not purchased property in Malaysia cannot open an account in Malaysia.

- Research and consultation for desired bank

- Bank accompaniment during account opening

- ATM card issuance

- Internet banking setup and usage guidance

Support Fees

●With valid Malaysian visa: RM2,000

●Property owner without valid Malaysian visa: RM2,500

2. Bank Accompaniment Support

Language barriers may prevent procedures from going as planned. We provide interpretation support for existing bank account procedures.

- Change notifications

- Account unfreezing

- ATM card reissuance

- Foreign currency account opening

- Internet banking setup and usage guidance

Support Fees

RM300 (up to 2 hours)

*Additional RM50/30min charge for overtime.

*Travel fees apply if the bank is far from our offices.

3. Internet Banking Support

We provide remote support via Zoom or LINE for internet banking usage and procedures.

Support Fees

Please contact us

Account Maintenance Notes

About Account Freezing

Typically, Malaysian banks will freeze (Inactive status) accounts with no withdrawals for 1 year.

Foreign banks will send a letter saying “Your account has been frozen, please visit a branch to reactivate”. However, local banks rarely send letters to overseas addresses, so please be careful.

Unfreezing is usually done on the spot at a branch with your passport.

If the “Inactive” status continues for more than 3 years, it escalates to “Unclaimed” status. In this case, you may need to visit the original branch where you opened the account, but unfreezing at the bank is still possible.

After 7+ years of frozen status, funds may be transferred to the government’s Unclaimed Department. Once transferred there, procedures become complex, so please be careful.

How to Withdraw from Savings Account Without Being in Malaysia

Here are some methods for your reference:

Account Maintenance Methods (Reference)

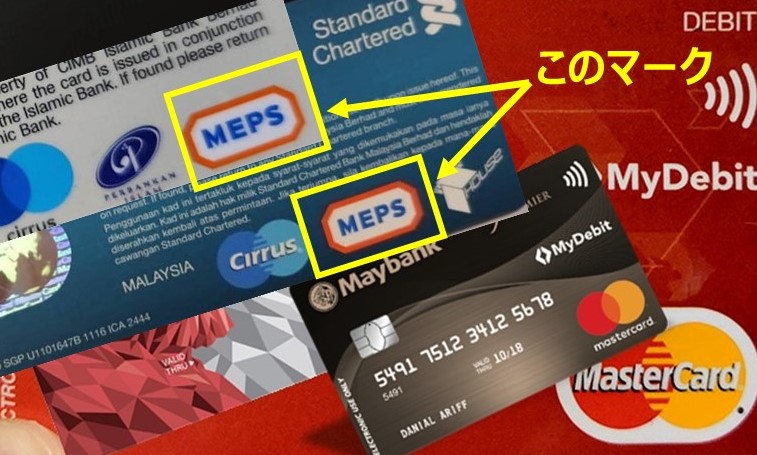

1. Withdraw at post offices or Seven Bank ATMs with your ATM card (check the logos on the back of your card for compatible locations)

2. Use your Malaysian bank ATM card’s debit function (VISA or Master) for shopping

*To use your ATM card overseas, it must be set for “overseas use”. Methods vary by bank, so confirm when applying for your card.

3. Use internet banking to transfer to other accounts, create fixed deposits, or move funds to foreign currency accounts

Your account holds your valuable funds – please manage it yourself.

Please feel free to contact our branches:

Kuala Lumpur: yoyaku@tpcl.jp (Matsunaga)

Penang: infopenang@tpcl.jp (Ishihara Ukatsu)

Johor Bahru: infojb@tpcl.jp (Pong)